As noted already by other people, gold does not provide any cash flows. Although most people consider it a hedge for inflation and think that its current rise was a result of inflation fears due to QE by major banks, in my view the reason is much simpler: Negative real interest rates. As long as the risk-free rate of return (for instance 1-Year Treasury) is negative in real terms, gold usually starts producing capital gains, something which happened both in the 1980’s as well as in the GFC. 2003 – 2004 was also a period of negative real rates when the price of gold also appreciated significantly, although at that time other low risk investment alternatives were available in the real sector (MBS and other securities).

The result is that gold (in real terms) has only appreciated during these two periods, staying between $200 – 300 for the rest of the time:

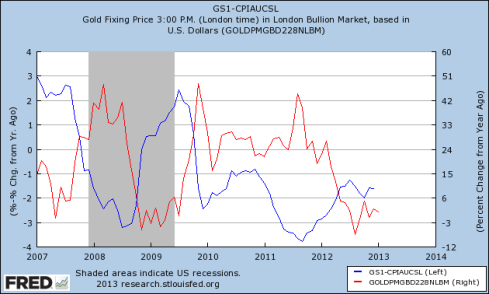

The above chart indicates that a return to the long-term trend would mean prices 2 – 3.5 times lower than current ones, eliminating a large part of capital currently invested into gold. Monetary tighting by the Fed in the near future (which has started to be indicated by certain FOMC members) will most probably have a strong effect on gold prices. This is indicated by the large correlation between the two since 2007 (the blue line is 1-Year Treasury minus CPI inflation rate):

Σχολιάστε

Comments feed for this article