You are currently browsing the category archive for the ‘central banking’ category.

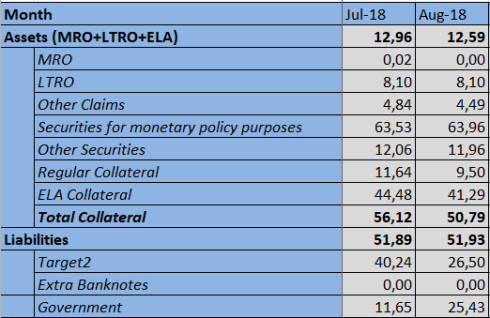

I recently wrote a post on the ECB waiver (for Greek government collateral) and what its expiration on 20 August would entail. Since BoG released its August balance sheet it seems that this question has been answered.

As is evident there was no significant change in the relevant amounts of either regular refinancing operations or ELA financing during August apart from a very small fall of €350mn. What actually changed was the total amount of collateral posted by Greek banks which fell by €5.33bn. Since regular financing operations total amount remained constant it appears that collateral quality was enhanced given that the relevant haircut was reduced from 30% to 15%.

It is obviously interesting to know how Greek banks managed such a task. Unfortunately, bank balance sheets data from BoG is not available for August so we will probably need to wait a bit more to find out.

One last interesting fact was the large increase in government deposits of close to €14bn which coincided with an equal drop in Target2 liabilities. This was due to the disbursement of the last round of funds towards the Greek government (by the ESM) which was used to increase its cash buffer. As a result, BoG now only «owes» €26.50bn to the Eurosystem while simultaneously holding €64bn in securities (mostly as a result of the QE program).

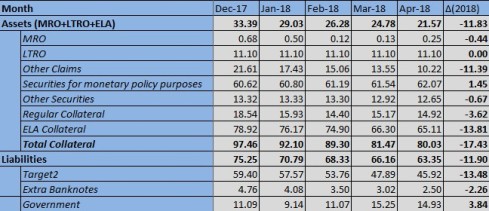

It’s been a while since I last looked into Bank of Greece balance sheet figures and given that the Greek central bank has released its April 2018 numbers I decided to take another quick look into them:

A few things stand out:

- Other claims (which is code for ELA) is down more than €11bn to a total close to €10bn. It is clear that Greek banks are moving closer to eliminating their need for non-standard financing, something which could happen during 2018. Obviously this also means that ELA income for BoG (and by extension for the Greek Treasury) will also show a significant decline (BoG should earn a bit more than €10mn/month as ELA profits by now).

- The big drop in ELA was mainly driven by a reduction of almost €16bn in BoG liabilities towards the Eurosystem (Target2 and banknotes) which total €48.4bn.

- Since BoG participation in Eurosystem QE continued at a slower pace the ‘Securities held for monetary policy purposes’ registered a further increase to €62bn. This means that BoG has a surplus of €13.5bn in securities held as assets compared to its liabilities towards the Eurosystem which would make a possible Grexit a bit easier since settlement of BoG Euro liabilities would be made using its (Euro government) securities portfolio.

- The lower need for CB financing has led total collateral posted at BoG down to €80bn, a figure which is quite manageable and far lower than the peak of €200bn reached during the 2015 turmoil. Most of the collateral are used for ELA financing so a possible elimination of ELA in the near future will make life much easier for Greek banks.

- Government deposits at the BoG are now close to €15bn registering an increase of €4bn during 2018. It seems that the Greek government is continuing its process of accumulating a large cash buffer for its «clean exit» scenario.

Overall BoG balance sheet figures suggest stabilization in external liabilities, ELA financing and a much lower toll on Greek bank profits from ELA loans (BoG should be around €40mn/month lower in April compared to a year ago).

Since the Eurosystem will be starting its QE program purchases this month while both 3Y-LTROs have already matured I would like to take a closer look at its balance sheet, especially in comparison with the last one before the large 3Y LTROs:

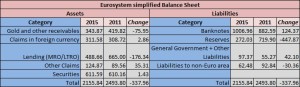

* total assets/liabilities are taken from the Eurosystem balance sheet and are not the sum of the simplified categories. Reserve requirements were 2% in 2011 instead of the current 1%.

From the asset side it is evident that bank lending is much lower even compared to financing before the LTROs while the Eurosystem securities portfolio is roughly the same as almost 3½ years ago. If one removes a bit more than €100bn from bank lending due to the lower reserve requirements it is clear that at least the sum of lending and securities are lower today than the level they reached during 2011.

Looking into the liabilities side we see that banknotes have increased by roughly €125bn while reserves are down almost €450bn. Even correcting for reserve requirements and banknotes, reserves are still roughly €200bn lower than their 2011 level. Although this cannot reflect anything other than increased ‘stability’ in the banking system, it also shows how much effort the ECB will have to exert in order to substantially increase excess reserves which currently stand at less than €200bn.

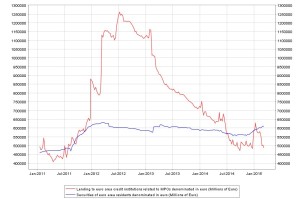

The above are also evident by looking at the chart of Eurosystem lending and security holdings which make it clear how the ECB is back to 2011Q3 levels in terms of its refinancing operations:

The first couple of months of ECB purchases will probably be used in order to overcome ‘inertia’ in the banking system and move excess reserves to levels that will significantly pressure money market rates. A first sign will probably be lower ‘EONIA heartbeats‘ as was the case after the settlement of the 3Y LTROs.

Since the second 3Y LTRO matured this week while the ECB QE starts in a few days it is interesting to take a quick look at the overall liquidity position of the European banking system. According to the latest Eurosystem weekly statement, lending through regular refinancing operations (MRO and LTROs) was €501.3bn during the preceding week (this does not include the sizable ELA lending of Greek banks which appears to have increased by €5.6bn).

Based on the outstanding OMOs, total lending now stands at €488,3bn. A large part of the maturing 3Y LTRO was replaced by higher MRO lending (which increased to €165.35bn from €122.11bn in the previous week) yet overall financing was €13bn lower and now stands at less than €500bn. In other words, total bank financing is now close to the allotted amounts of each of the two 3Y LTROs (first: €489.2bn, second: €529.5bn).

Obviously the European banking system has lowered its reliance on Eurosystem financing substantially. It seems that any increase in the Eurosystem balance sheet will only be the product of outright purchases through the ABSPP/CBPP3 and government bond program. It is even probable that individual banks will use the newly created reserves in order to reduce their reliance on Eurosystem financing and free encumbered collateral which will result in lower MRO allotments in the next few weeks. Consequently, one should observe almost immediate effects on repo market rates and turnover by the upcoming ECB QE purchases.

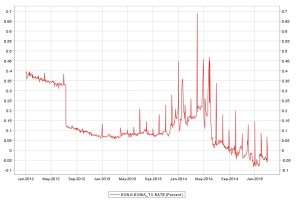

Since I recently submitted my MSc in Finance dissertation titled «The informational content of SMP deposit auctions in forecasting short-term repurchase agreement interest rates», I would like to take the opportunity to write a few words on its conclusions. The main objective of the research was to examine whether SMP deposit auctions carried valuable information for forecasting short-term repo rates. Since banks with excess liquidity always faced the choice between parking their reserves at the weekly term-deposits for a week or lending them in the GC repo market, SMP deposit rates should act as an effective floor on risk-free money market rates.

In order to evaluate the above hypothesis the paper first suggested a stochastic model for the bid rate in auctions (based mainly on the level of excess reserves in the system) as well as the conditional variance of the bid rate process (the calculation suggested that the variance was not steady but a function of excess reserves therefore implying that a possible econometric specification would face heteroskedasticity problems).

The econometric specification used a cointegrating relationship between the weekly GC and SMP deposits rate in a VEC model also containing excess bids, number of bids and the VIX index (as a proxy of market stress) as explanatory variables. A competing VAR model of the MRO and GC rate was estimated and out of sample forecasts of the GC rate for the two models were compared. The results clearly indicated that the SMP deposits did provide significant informational content for short-term money market rates.

A few people might find the (very) large section in monetary policy and repo market details informative and helpful. Overall the paper is quite technical but I hope relevant for evaluating the effectiveness of certain sterilization tools used by central banks in recent years. It might prove useful in analyzing related facilities used by the Federal Reserve (such as Interest on Reserves and the overnight and term reverse repo facilities), a topic that interests myself as well.

So it seems that a European QE program is highly probable although Greek government debt is at risk of not being included since it is not rated investment grade and the ECB will only include it in the list of assets purchased if Greece remains in a refinancing program.

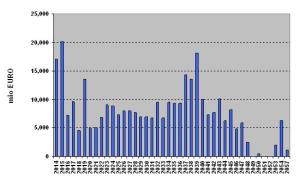

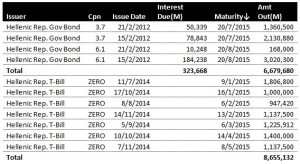

In this short post I ‘d like to note a few things on the magnitude of the impact that such a program would have on Greek bonds. Based on the Greek ECB capital key (2%) and the anticipated QE size (which most analysts put around €500bn), the ECB might end up buying around €10bn of Greek debt securities. PSI related bonds principal is now around €29.6bn while long-term bonds issued by the Greek government during 2014 totaled another €6.9bn. Bonds with a residual maturity of up to 10 years are only €12,2bn which, given current market prices, are worth much less than €10bn.

As a result, ECB will ultimately be making a bid for all the outstanding market value of long-term Greek bonds (with a residual maturity of up to 10 years), increasing liquidity in the bond market considerably (and making it the largest holder of Greek debt). That will obviously drive current market prices much higher and also allow the Greek government to immediately return to the market since bidders will have a (free) put option of selling most of their holdings to the ECB. As long as the upcoming QE is pari passu with private bondholders (as is the OMT program) and the Greek government establishes a credit line program (which creates another put option for bondholders) the (QE) program will allow an orderly return of the Greek government to private bond markets.

Since the Greek debt maturity profile suggests that only mostly 2015 and 2019 are years that involve large debt refinancing needs (which lowers any default risk post 2015) a QE program will have long-lasting stabilization effects. These effects will be even higher if ECB profits from the program are returned to the corresponding Treasuries (which I suspect will happen if eventually the program involves each NCB buying its own government debt securities).

Personally I would also like to see a second buyback of Greek debt to take advantage of low market prices and also to lower the nominal value of post-PSI bonds which, due to the EFSF co-financing scheme, are senior to newer bonds issued by the Greek government (a fact that can create difficulties for Greece issuing bonds that have similar maturity dates as outstanding PSI bonds). A possible buyback could be combined with an exchange offer to consolidate the current series (which stretch a 20 year period with low nominal values per bond of less than €1.5bn) into two or three securities that will be of much larger nominal value and liquidity and thus improve market making and secondary market trading.

Given the recent substantial increase in Greek political risk and the high probability of early elections I ‘d like to comment on a recurring theory that ECB can threaten to close down Greek banks access to liquidity (in the same manner it did in Cyprus) in case that a newly elected Syriza government does not adhere to the currently agreed upon measures, reforms and budget cuts.

In my view, 2015 is quite different than 2012 and the possible threats that the ECB could (then) make against Greece are no longer possible.

The main measure that the ECB can take against Greece in case that the current program is put on hold is to remove the waiver on accepting Greek government guaranteed securities and other assets as collateral in its regular refinancing operations. The important fact to keep in mind though is that Greek banks do not hold significant amounts of Greek government bonds on their balance sheets any more. They only have a little over €10bn of relevant securities of which almost €5bn are Treasury Bills. The collateral being used in ECB operations are mainly the EFSF notes that banks acquired from the Hellenic Financial Stability Fund (HFSF) when they were recapitalized after the PSI. The nominal value of these notes exceeds €37bn which coupled with other assets (such as credit claims) covers current ECB financing which stands close to €45bn.

Any additional financing requirements can be covered through ELA financing although this will necessarily result into much higher borrowing costs (since the ELA rate is more than 150bps higher than the ECB marginal lending rate). The threat of closing down ELA (as in Cyprus during 2013) is only possible if the Greek banks do not cover minimum capital requirements. Given that it’s only been a few weeks since the ECB stress test results were announced during which the central bank affirmed the strong capital position of Greek banking institutions it is not at all clear how the ECB would be able to justify not allowing or placing hard limits on ELA financing.

Moreover, even if negotiations between Greece and its creditors go south this cannot have any effect on the EFSF notes held by banks since any principal and interest payments on EFSF loans will be made after 2020 (interest payments have been deferred and capitalized until at least 2022). Coupon payments on PSI bonds (including bonds issued during 2014) stand around €1bn per year and do not create substantial problems. Unfortunately the EFSF loan does contain cross default clauses referring to the rest of Greek obligations so a future Greek government should proceed with caution although the Greek law covering ECB SMP bonds does provide some room to maneuver* .

Greek debt payments during 2015 mainly involve T-Bill rollovers and payments of €7bn towards the ECB (for SMP bonds) and €9bn towards the IMF:

ECB’s main leverage over Greece concerns whether liquidity will be provided through regular OMOs or ELA and if Greek bonds will be included in a possible future QE program. The latter will obviously allow a much more orderly access to capital markets for bond issuance, especially coupled with the presence of an EFSF ECCL program.

* When I first wrote the post I had in mind that ECB Greek bonds are covered by Greek law. It turns that the ‘default events’ on the EFSF financing agreement cover more or less all of Greek government liabilities.

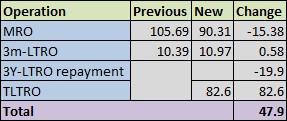

ECB’s Targeted LTRO is now a reality. What I would like to examine in this short post is the fact that actual net liquidity injection will not be equal to the TLTRO’s allotment as most people would think but the net result of various liquidity providing operations and LTRO repayments. More specifically, net liquidity will be the sum of:

- TLTRO allotment (€82.6bn)

- Repayments of earlier 3Y-LTROs which increased substantially after the TLTRO auction (a total of €19.9bn)

- Changes in MROs

- Changes in maturing (3-month) LTRO rollovers.

Adding today’s 3m-LTRO rollover the data are as follows:

Overall, ECB’s first TLTRO managed to inject a total of €48bn of net liquidity. Given the stated target of increasing the ECB balance sheet by close to €1tr it is clear that the operation was a drop in the ocean. European banks most probably used a large chunk of the TLTRO funds in order to replace 3Y-LTRO funding (the corresponding operations mature in a few months time) and MRO liquidity (replace short-term funding at a variable rate with stable long-term funding at a constant rate only 10bp higher than the current MRO rate) rather than to immediately expand their reserve position. Given that the remaining liquidity due to the 2 3Y-LTRO is still well over €300bn and will be maturing in a few months time it seems that a large part of the TLTROs will go in rolling over these reserves instead of creating additional excess liquidity.

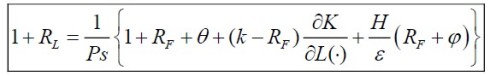

Recently we had to write a large essay on the bank loan pricing procedure of the banking system under imperfect competition (for the banking course we ‘re currently attending). The end result was quite interesting and we have posted it as a Working Paper on ssrn. The paper is heavily based on the relevant work of Ruthenberg and Landskroner (2008) which has been extended with more realistic assumptions such as a non-zero Recovery Rate on loans and a securities portfolio to match capital and reserves.

The paper first describes a few stylized facts of modern banking with sections on modern monetary policy implementation and the actual interbank market (where monetary policy acts as an interest rate cap on ‘competitive spreads’). This is followed by a general (stochastic) model for the term and credit risk premium added on loan rates.

The model assumes that a bank finances a new loan by borrowing in the interbank market under Cournot oligopoly and Basel capital requirements. We only examine the case of a properly functioning interbank market with very low excess reserves and liquidity hoarding. The end result is the following equation:

where RL is the loan rate, Ps the borrower’s probability of survival, Rf the risk-free rate, θ the spread in the interbank market over the risk-free rate, k cost of equity (RoE), H the Herfindhal-Hirschman index of concentration in the loan market, ε the elasticity of demand in terms of RL for new loans by bank customers and φ is the risk premium per borrower which is equal to:

φ = PD x LGD

(PD: Probability of default or 1-Ps and LGD: Loss-Given-Default).

Based on the above equation, it is clear that the main drivers of the loan rate are the Probability of Default and the risk-free rate (these two factors account for over 90% of the loan rate). PD enters the equation both as a ‘compounding factor’ and in the risk premium φ. The end result is that for PD higher than 5% the compounding factor increases substantially and a loan becomes very expensive. The obvious conclusion is that the PD is used as a ‘first line of defence’ by banks in order to determine if a loan will be offered in the first place and the amount made available (especially as a percentage of available collateral, proxied by the Loan-to-Value ratio).

This explains why credit crises and large recessions lead to a ‘credit crunch’ since a large enough PD will result in loan rejections and not in a (very large) increase of the offered loan rate. Updates to a borrower’s PD /LGD (after a loan has been extended) are usually large enough that a bank cannot include them in the loan rate risk premium (without pushing a borrower to an early default) and are incorporated in Loan-Loss provisions.

Under perfect competition (H close to zero) banks are not able to earn a premium over the risk-free rate (apart from the borrower risk premium) and only get their required RoE. If market power exists banks are capable of gaining an above normal profit which is rather marginal for H lower than 0.1 (usually lower than 10% of the risk-free rate). For large enough HHI the premium becomes quite significant.

Both the RoE and Basel capital requirements play a role in the loan rate offered although that depends mainly on the loan’s risk weight.

The model specification was followed by a simple application in the Greek banking system during the Euro era (and before the 2007-2008 credit crisis). Although we did not use any econometric techniques in this essay, the model performed quite well with an R² of 0.93. Given the current HHI of 0.214 it seems that banks have gained (through M & As) significant market power and are able to impose a premium of close to 30% over the risk-free rate in their quoted loan rates (based on the model’s projections).

Our next step is to use the model in order to look into the Greek banking system with more detail and estimate an econometric specification. Still, the basic stylized facts that can be drawn are quite significant and can explain why credit crises lead to a credit crunch and how higher probabilities of default eat into bank profits through loan-loss provisions. Obviously we would appreciate any comments on the paper and the outlined model.

In this short post I would like to emphasize the important role of the ECB (conditional) commitment for Outright Monetary Operations (OMT) in reducing tail risks and credit spreads in the Euro periphery bond markets. In order to do that I will analyze OMT in terms of option pricing and insurance.

The role and details of OMT are quite well known by now. The main factors that made the commitment so successful (without even having to implement them) were:

- The OMT portfolio will be pari passu with private bondholders. As a result, bonds purchases by the ECB do not create a senior debt-holder (as was the case for the SMP portfolio) while remittance of Eurosystem profits due to these operations allows troubled debt countries to effectively earn seignorage income and lower their debt servicing costs.

- Operations are conditional on an official bailout (which is usually accompanied by strict conditionality). Since bailouts tend to favor creditors at the expense of domestic citizens (with austerity measures targeting essential government services and private sector wages but usually not capital income and gains) they lower the risk of debt restructuring in the sense of making it much more difficult for the debtor country to prioritize its own citizens welfare. Furthermore, by having the ECB buy a large part of the country’s debt, private bondholders are not subordinated in the same way as a pure ESM bailout.

- The fact that the ECB will probably remit its OMT profits back to the debtor country plus the low interest rates in ESM loans (in contrast with the initial high rates of the Greek Loan Facility) mean that a large part of a country’s deficit reduction will come from interest expenses and not from savings in expenses or higher taxes with a much milder result on economic growth (and a positive impact on long-run debt sustainability).

Still a lot of people find it odd that OMT was able to lower spreads by such a large amount without any operations actually taking place in the bond markets. One has to realize that by committing to OMT, the ECB is essentially setting a ceiling on the spread of government bonds (although a bit vague) since any large increase in credit spreads will lead a country to ask for a bailout and an activation of OMT. As a result, a private bond holder is guaranteed that the price of her bonds will not fall lower than a specific floor, since in that case, she will have the option of ‘selling’ them to the ECB. In other words, the ECB is writing a set of ‘free’ put options on Eurozone debt, standing ready to buy bonds at current market prices after the relevant country has requested a bailout.

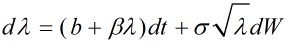

In order to look into the issue from a more technical angle, lets assume that the bond hazard rate (probability of default in a period conditional on survival until that period) follows an Ito process similar to the CIR process of interest rates (see Filipovic, chapter 13):

where W is a Wiener process. Given this process one can calculate the default probability which (although quite technical) obviously depends on the drift parameters (b,β) but more importantly on the volatility as well. As a result, if volatility is modeled in an autoregressive model such as GARCH(1,1), periods of high bond price volatility quickly lead to higher estimates of default probabilities. Since the default probability can be considered as the Ν(-d2) term of a credit risk put option (with a strike price equal to the expectation of the recovery rate), the model estimated probability can be used for option pricing and bond portfolio insurance.

where W is a Wiener process. Given this process one can calculate the default probability which (although quite technical) obviously depends on the drift parameters (b,β) but more importantly on the volatility as well. As a result, if volatility is modeled in an autoregressive model such as GARCH(1,1), periods of high bond price volatility quickly lead to higher estimates of default probabilities. Since the default probability can be considered as the Ν(-d2) term of a credit risk put option (with a strike price equal to the expectation of the recovery rate), the model estimated probability can be used for option pricing and bond portfolio insurance.

By insurance I am referring to the policy of creating a synthetic put option (by shorting bonds) in order to insure a bond portfolio from downside risks.This has the advantage that the bond holder does not have to keep a matched book bond position but only short the proportion (determined by the default probability) of the portfolio needed to hedge against the tail risk of default (assuming of course that interest risks have already been hedged through an IRS for instance) while earning all upside gains. An increase in the default probability increases the proportion necessary to hedge the downside risk, a strategy that can create self-fulfilling issues since the bondholders sell when bond prices fall and might face difficulties in borrowing bonds (to short) through reverse repos.

By introducing OMT, the ECB becomes the writer of the above option (something very similar to a CDS) and removes the need for active hedging. This immediately reduces bond volatility (since bondholders do not need to increase their short positions) while a high σ actually makes the option more valuable and pushes bond prices higher. Periods of high volatility (such as the summer of 2012) are immediately followed by a drop in volatility under efficient markets. As long as the ECB commitment is not questioned, Euro bond prices include this put option and permanently increase in price by market forces without a need for any actual ECB operations.

Obviously, the stability of the ECB determination to implement unlimited bond purchases will play a decisive role in the future (given the recent German Constitutional Court case for instance) yet it is clear that at this point, OMT has played a decisive role in minimizing Eurozone tail risks and lowering Euro periphery countries debt costs.