Yesterday the IMF released its debt sustainability analysis for Greece based on developments during 2015 (but not including the bank holiday and capital controls imposed after the referendum announcement). I consider it a very important document mainly because it shows (probably for the first time) how the basic assumptions of the adjustment programs were terribly optimistic and significantly disconnected from reality. It is also the first time that I know of that the IMF includes a (highly probable) scenario which requires Europe to write off part of Greek official debt (basically the Greek Loan Facility of €53bn) in order for the latter to become sustainable. It seems that the IMF has decided to catch up with reality. Having its largest ever program in arrears probably also played a role.

The first part of the analysis describes how some of the developments since June 2014 improved debt sustainability. These include:

- Lower interest rates future path due to easing of monetary conditions in the Euro area which contribute a total reduction of €23.5bn in Greece’s debt up until 2022.

- The return of the HFSF bank recapitalization buffer of €10.9bn. Obviously the IMF is not being honest in this point since the buffer will be needed in one form or another for further capital injections in Greek banks and/or for the creation of a bad bank to clear NPLs.

- Intra-governmental borrowing of about €11bn to cover debt repayments which the IMF assumes that 2/3 will be sustained for the indefinite future by rolling over this short-term borrowing. This action will lead to an improvement of the debt-to-GDP ratio of 5% GDP.

On the other hand weaker GDP performance and downward revision of historical GDP contributed to an increase by 4% GDP of the 2022 debt-to-GDP ratio. Overall, taking all the above developments into account would improve the 2020 debt ratio to 116.5% (from a projection of 127.7% in the June 2014 review).

Yet at the same time the IMF has to acknowledge reality which includes much lower primary surplus targets, lower privatization proceeds, lower GDP growth, clearing arrears and rebuilding buffers as well as paying down a part of the short-term intergovernmental borrowing. This reality results in a total of financing needs of €52bn from October 2015 up to 2018 with the 12-month forward financing requirements from October 2015 amounting to €29bn.

Let’s take a closer look at a few aspects of ‘reality’.

First of all, primary surplus targets have been reduced from 3% for 2015 and 4.5% for 2016 onwards to 1% during 2015, 2% for 2016, 3% for 2017 and 3.5% for 2018 and beyond. Although in my opinion Greece should only be looking at the structural (cyclically adjusted) primary balance with official lenders taking the risk of short-term economic developments, these short-term targets are obviously much closer to the actual reality on the ground.

What is quite impressive is how the IMF has revised down its privatization proceeds targets. Projected privatizations were €23bn over the 2014-22 horizon yet only €3bn materialized during the last 5 years (the ‘fire sales’ argument of the current Greek government). As a result, the IMF now has much lower (and reasonable) targets of annual proceeds of around €500mn over the next few years. The magnitude of the targets revisions in each review is interesting:

What is the most important part of the document in my opinion is the analysis of long-term economic growth. The IMF acknowledges that its long-term growth target of 2% was unattainable and conditional on unreasonable assumptions and has now been updated to a still very ambitious target of 1.5%. It is clear from the document that even this target will most likely be missed. Only short-term targets based on closing the output gap and subject to a return of confidence are attainable in my opinion. In the words of the IMF itself:

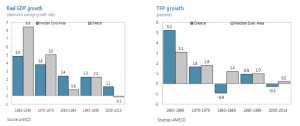

Medium- to long-term growth projections in the program have been premised on full and decisive implementation of structural reforms that raises potential growth to 2 percent. Such growth rates stand in marked contrast to the historical record: real GDP growth since Greece joined the EU in 1981 has averaged 0.9 percent per year through multiple and full boom-bust cycles and TFP growth has averaged a mere 0.1 percent per year. To achieve TFP growth that is similar to what has been achieved in other euro area countries, implementation of structural reforms is therefore critical.

What would real GDP growth look like if TFP growth were to remain at the historical average rates since Greece joined the EU? Given the shrinking working-age population (as projected by Eurostat) and maintaining investment at its projected ratio of 19 percent of GDP from 2019 onwards (up from 11 percent currently), real GDP growth would be expected to average –0.6 percent per year in steady state. If labor force participation increased to the highest in the euro area, unemployment fell to German levels, and TFP growth reached the average in the euro area since 1980, real GDP growth would average 0.8 percent of GDP. Only if TFP growth were to reach Irish levels, that is, the best performer in the euro area, would real GDP growth average about 2 percent in steady state. With a weakening of the reform effort, it is implausible to argue for maintaining steady state growth of 2 percent. A slightly more modest, yet still ambitious, TFP growth assumption, with strong assumptions of employment growth, would argue for steady state growth of 1½ percent per year.

What the IMF also acknowledges is that any serious ‘return to markets’ from Greece will quickly make the current debt figures unsustainable because higher market rates will not be consistent with debt sustainability. As a result, in order for official creditors to avoid haircuts, more financing will be needed with concessional financing and a doubling of the grace and maturity period of loans.

It is unlikely that Greece will be able to close its financing gaps from the markets on terms consistent with debt sustainability. The central issue is that public debt cannot migrate back onto the balance sheet of the private sector at rates consistent with debt sustainability, until debt-to-GDP is much lower with correspondingly lower risk premia (see Figure 4i). Therefore, it is imperative for debt sustainability that the euro area member states provide additional resources of at least €36 billion on highly concessional terms (AAA interest rates, long maturities, and grace period) to fully cover the financing needs through end–2018, in the context of a third EU program (see also paragraph 10).

Even with concessional financing through 2018, debt would remain very high for decades and highly vulnerable to shocks. Assuming official (concessional) financing through end– 2018, the debt-to-GDP ratio is projected at about 150 percent in 2020, and close to 140 percent in 2022 (see Figure 4ii). Using the thresholds agreed in November 2012, a haircut that yields a reduction in debt of over 30 percent of GDP would be required to meet the November 2012 debt targets. With debt remaining very high, any further deterioration in growth rates or in the medium-term primary surplus relative to the revised baseline scenario discussed here would result in significant increases in debt and gross financing needs (see robustness tests in the next section below). This points to the high vulnerability of the debt dynamics.In particular, if primary surpluses or growth were lowered as per the new policy package—primary surpluses of 3.5 percent of GDP, real GDP growth of 1½ percent in steady state, and more realistic privatization proceeds of about €½ billion annually—debt servicing would rise and debt/GDP would plateau at very high levels (see Figure 4i). For still lower primary surpluses or growth, debt servicing and debt/GDP rises unsustainably. The debt dynamics are unsustainable because as mentioned above, over time, costly market financing is replacing highly subsidized official sector financing, and the primary surpluses are insufficient to offset the difference. In other words, it is simply not reasonable to expect the large official sector held debt to migrate back onto the balance sheets of the private sector at rates consistent with debt sustainability.

Given the fragile debt dynamics, further concessions are necessary to restore debt sustainability. As an illustration, one option for recovering sustainability would be to extend the grace period to 20 years and the amortization period to 40 years on existing EU loans and to provide new official sector loans to cover financing needs falling due on similar terms at least through 2018. The scenario below considers this doubling of the grace and maturity periods of EU loans (except those for bank recap funds, which already have very long grace periods). In this scenario (see charts below), while the November 2012 debt/GDP targets would not be achievable, the gross financing needs would average 10 percent of GDP during 2015-2045, the level targeted at the time of the last review.

If grace periods and maturities on existing European loans are doubled and if new financing is provided for the next few years on similar concessional terms, debt can be deemed to be sustainable with high probability. Underpinning this assessment is the following: (i) more plausible assumptions—given persistent underperformance—than in the past reviews for the primary surplus targets, growth rates, privatization proceeds, and interest rates, all of which reduce the downside risk embedded in previous analyses. This still leads to gross financing needs under the baseline not only below 15 percent of GDP but at the same levels as at the last review; and (ii) delivery of debt relief that to date have been promised but are assumed to materialize in this analysis.

What is also important is that a reasonable scenario which includes of long-term growth close to 1% and a medium-term primary surplus target of 2.5% of GDP would require a haircut by official lenders:

However, lowering the primary surplus target even further in this lower growth environment would imply unsustainable debt dynamics. If the medium-term primary surplus target were to be reduced to 2½ percent of GDP, say because this is all that the Greek authorities could credibly commit to, then the debt-to-GDP trajectory would be unsustainable even with the 10-year concessional financing assumed in the previous scenario. Gross financing needs and debt-to-GDP would surge owing to the need to pay for the fiscal relaxation of 1 percent of GDP per year with new borrowing at market terms. Thus, any substantial deviation from the package of reforms under consideration—in the form of lower primary surpluses and weaker reforms—would require substantially more financing and debt relief (Figure 7).

In such a case, a haircut would be needed, along with extended concessional financing with fixed interest rates locked at current levels. A lower medium-term primary surplus of 2½ percent of GDP and lower real GDP growth of 1 percent per year would require not only concessional financing with fixed interest rates through 2020 to cover gaps as well as doubling of grace and maturities on existing debt but also a significant haircut of debt, for instance, full write-off of the stock outstanding in the GLF facility (€53.1 billion) or any other similar operation. The debt-to-GDP ratio would decline immediately, but “flattens” afterwards amid low economic growth and reduced primary surpluses. The stock and flow treatment, nevertheless, are able to bring the GFN-to-GDP trajectory back to safe ranges for the next three decades (Figure 8).

If one includes the fallout of the bank holiday it seems that we have clearly reached the end game. A recession during 2015 along with a low primary surplus will make the current DSA a bit outdated. Deciding to base the DSA on actually achievable targets (which in my opinion only include the ‘adverse scenario’ of 2.5% primary surplus target and 1% long-term GDP growth) will mean that Europe will (finally) have to consider a debt write-off. That is the economic reality on the ground. The way that the official sector reacts to it and the targets it (tries to) sets for the new Greek medium-term program will say a lot about who will bear the costs of further adjustment. In my view the policy of ‘externalizing’ the costs on the Greek economy and ‘extend and pretend’ is almost over, at least in democratic terms. Unfortunately, now will be the time of the politicians, name calling and trying to place the blame on the other party.

PS: It is also quite strange how the IMF puts such high value on ‘structural reforms’, when its own research shows that, at least ‘reforms’ that do not include more funding of investment in high-skilled labor, R&D, ICT capital and infrastructure but target the usual suspects of product and labor market have negative short-term and neutral long-term effects (labor market) or only marginally positive results (product markets). Only financing of serious investment in R&D, ICT capital and (to a lesser part) infrastructure can result in substantial effects on long-term TFP growth.

Σχολιάστε

Comments feed for this article